franklin county ohio tax lien sales

FRANKLIN COUNTY JUSTICE SYSTEM. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent.

574713 Liability of employer or taxpayer for failure to file return or collect or remit tax.

. Franklin County OH currently has 4056 tax liens available as of October 9. The property is sold to the successful bidder state laws differ. Generally the minimum bid at an Franklin County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property.

In an effort to recover lost tax revenue tax delinquent property located in Franklin Ohio is sold at the Warren County tax sale. According to the provisions of Ohio Revised Code ORC Chapter 5721 Ohio tax liens are. An Ohio tax lien is imposed against the real estate of a debtor following non-payment of taxes.

Ohio Tax Lien Law Oh. The tax lien certificate sale is generally held in October or November each year but can also be negotiated with the County Land Bank. Postmark does not apply Gross Real.

Non-payment of Real Estate taxes could result in a foreclosure action tax lien sale or other legal action in order to collect the taxes that are necessary to fund the countys schools. Franklin County Treasurer - Tax Lien Sale new treasurerfranklincountyohiogov. Youll need to call our Fiscal Department at 6145252442 and request the amount due for associated court costs to file this matter through the Franklin County Clerk of Courts.

2022 TAX LIEN SALE The Franklin County Treasurers. When a Franklin County OH tax lien is issued for unpaid past due balances Franklin County OH creates a tax-lien certificate that includes the amount of. FRANKLIN COUNTY OHIO Tax Lien Certificate Sale Thursday September 5 2013 Share FRANKLIN COUNTY OHIO-The next Treasurers Tax-Lien Certificate Sale in Franklin.

How does a tax lien sale work. When a Franklin County OH tax lien is issued for unpaid past due balances Franklin County OH creates a tax-lien certificate that includes the amount of the. Franklin County Treasurer 373 South High Street 17th Floor Columbus OH 43215-6306.

121800 10600 510 43223 2017 50669799999999996 531698 250. The Columbus Bar Association has a legal referral service which can be reached at 614-221-0754 or toll-free at 877-560-1014. 107800 11000 510 43203 2021 177942 202942 250.

Edward Leonard Franklin County OH treasurer makes this clear. 20200 151600 420 43229 2021 452257 477257 250. 574713 A Notice of a.

2022 TAX LIEN SALE The Franklin County Treasurers. Additional interest charges foreclosure or tax lien sale. The tax lien certificate sale is generally held in October or November each year but can also be negotiated with the County Land Bank.

The purpose of the annual Tax Lien Sale is to collect the delinquent real estate taxes owed to the Countys school. 3 Arrange a payment plan with the Attorney. How does a tax lien sale work.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. Nationwide tax sale data to power your investing. Consolidated Franklin County Ohio tax sale information to make your research quick easy and convenient.

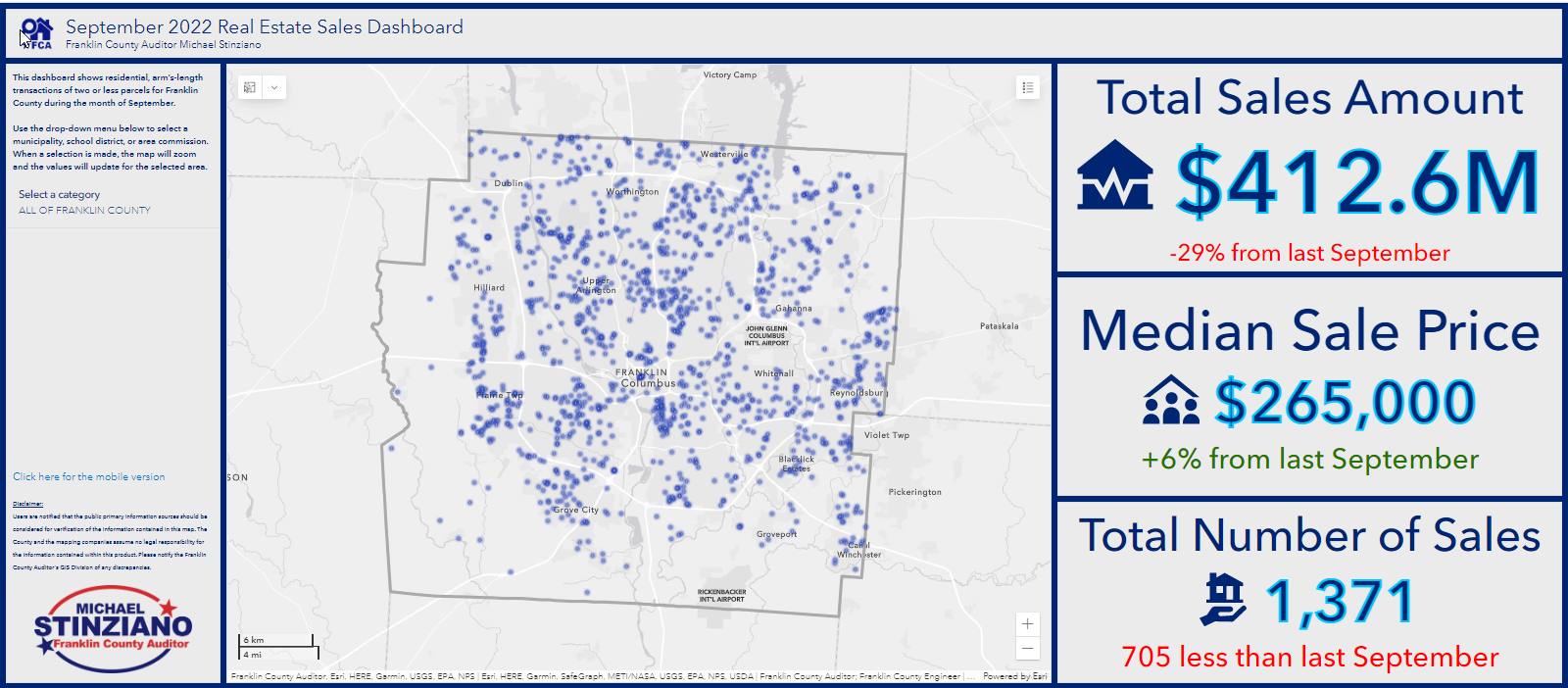

The Franklin County Auditors Office is a leader in public service and provides quality cost-effective information and services to all Franklin County residents.

Ohio S Administrative Not Judicial Income Tax Liens Frost Brown Todd Full Service Law Firm

Miami County Ohio Tax Lien Tax Deed Sale Information

I Owe Ohio Sales Tax But Never Even Made A Sale J M Sells Law Ltd

Blight Removal Cocic The Land Reutilization Corporation Of Franklin County

Franklin County Treasurer Delinquent Taxes

Franklin County Sheriff Real Estate Sales

Investing In Tax Liens In Ohio Joseph Joseph Hanna

Columbus Housing Market Prices Trends Forecasts 2022

Delinquent Taxes Franklin County Clerk

![]()

General Information Franklin County Tax Office

Motionname Columbus Servicing Agency Llcplntif Defndt Ind Pattorney Name Joseph L Beykeattorney Address Beyke Law Llcsuite 288561 S Mason Montgomery Mason Oh 45040 513 346 2836motion Counter 0002action Has Been Granted January 14 2020 Trellis

Information For Creditors Ohio Judgment Collection Law Libguides At Franklin County Law Library

Franklin County New York Property Taxes 2022

County Clerk Recorder Franklin County

Satisfying Tax Liens In Franklin County Ohio Tax Liens Libguides At Franklin County Law Library